Will Diverging Analyst Optimism and Insider Selling Shift Confluent’s (CFLT) Investment Narrative?

- J.P. Morgan recently initiated coverage on Confluent with a Buy rating, joining other major firms like Guggenheim and RBC Capital in expressing optimism about the company’s prospects.

- This influx of positive analyst opinions comes despite increased insider selling activity, highlighting a divergence between analyst sentiment and insider behavior.

- We’ll explore how J.P. Morgan’s new positive coverage influences Confluent’s investment narrative and market perception.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Confluent Investment Narrative Recap

Investors in Confluent are generally betting on continued growth in real-time AI and data streaming adoption, which hinges on the company’s ability to drive cloud and platform revenue amidst stiff competition. The recent Buy rating from J.P. Morgan reinforces positive analyst sentiment, but given persistent headwinds in Confluent Cloud consumption growth and rising insider selling, this coverage does not materially change the biggest short-term catalyst, next week’s earnings report, or the key risk of cloud revenue deceleration.

Of the recent announcements, the upcoming Q3 2025 earnings release on October 27 stands out as the most relevant, with both revenue expectations and forward guidance likely to influence investor sentiment and potentially clarify the trajectory for subscription revenue growth. Results here could provide better visibility on whether the positive analyst coverage is justified by actual performance or if slower cloud adoption continues to weigh on near-term outlook.

By contrast, investors should also be aware of the mounting risk that competitive pressure and customer migration to open-source or self-managed alternatives could lead to…

Read the full narrative on Confluent (it’s free!)

Confluent’s outlook anticipates $1.7 billion in revenue and $220.6 million in earnings by 2028. This scenario requires 16.5% annual revenue growth and a $532.3 million increase in earnings from the current level of -$311.7 million.

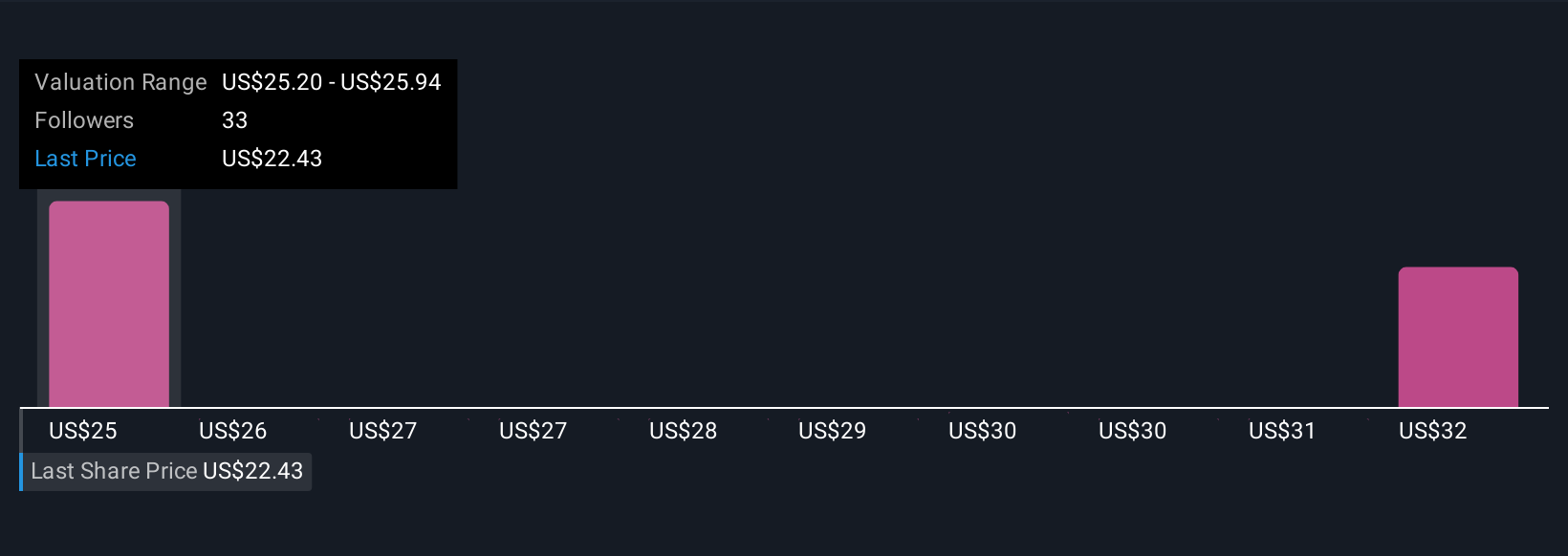

Uncover how Confluent’s forecasts yield a $25.20 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three member-generated fair value estimates from the Simply Wall St Community range from US$25.20 to US$32.69 per share. While some see substantial upside, many remain focused on whether cloud revenue growth can keep pace with expanding addressable market expectations.

Explore 3 other fair value estimates on Confluent – why the stock might be worth as much as 43% more than the current price!

Build Your Own Confluent Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Confluent?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link