China-Germany Trade and Investment Outlook 2026

China-Germany Trade and Investment Outlook 2026 highlights how bilateral ties are evolving toward technology, supply chain resilience, and green industry. As China overtakes the US as Germany’s largest trading partner, both economies are focusing on innovation-led growth and energy transition. This article explores policy changes, FDI trends, and sector opportunities shaping strategic business decisions.

Find Business Support

China and Germany remain key economic partners, maintaining a close interconnection through advanced manufacturing and technology trade. In the first eight months of 2025, China overtook the United States (US) to once again become Germany’s largest trading partner, with bilateral trade reaching €163.4 billion (US$189.7 billion), highlighting the resilience of economic ties despite rising geopolitical pressures. Heading into 2026, both economies are advancing a strategic shift: China toward innovation-led growth, Germany toward supply chain resilience and energy transition, signaling a new phase of pragmatic economic engagement.

Despite geopolitical headwinds, sectors such as electric vehicles, hydrogen energy, pharmaceuticals, and automation continue to offer strong growth potential, prompting firms to adapt strategies to remain competitive.

This article provides a forward-looking analysis of current China-Germany trade and investment ties. It examines policy shifts, trade flows, investment patterns, and sector-level opportunities to help businesses identify areas for growth and long-term positioning.

Policy and geopolitical landscape

China and Germany’s interests in industrial innovation are aligned, despite diverging strategic priorities shaped by geopolitical realities. Policy developments on both sides are redefining how companies operate, invest, and manage risk, especially in technology-intensive and energy-related sectors.

China’s economic priorities

China’s policy direction is evolving toward the development of “New Quality Productive Forces,” prioritizing innovation-led industrial upgrading in areas such as advanced manufacturing, AI, and renewable energy. This shift builds on the dual circulation framework but places greater emphasis on strengthening technological autonomy and accelerating high-productivity growth sectors. Consumption-driven growth is supported by employment stabilization and targeted incentives. At the same time, China continues to encourage “high-quality” foreign direct investment (FDI), specifically in sectors that support innovation, green development, and supply chain integration.

Germany’s de-risking strategy and the EU policy environment

Germany’s 2023 China Strategy prioritizes de-risking through supply chain diversification, export controls, and tighter screening of inbound investment in strategic sectors such as semiconductors and critical infrastructure, without pursuing full decoupling. However, recent tariff actions by the United States have accelerated shifts in German trade flows back toward China, reflecting how geopolitical pressures are reinforcing—rather than diminishing—bilateral economic interdependence

At the EU level, regulatory pressure is increasing. The Carbon Border Adjustment Mechanism (CBAM) is reshaping industrial trade flows, particularly for steel, aluminum, and chemical imports from China. Additionally, the European Commission has launched foreign subsidy investigations into Chinese electric vehicle manufacturers, which could lead to countervailing duties or new compliance requirements. These actions reflect a broader shift toward protectionist measures aimed at safeguarding European industrial competitiveness.

Recent bilateral engagement

Despite growing scrutiny, economic dialogue remains active. The most recent session of the China–Germany Joint Economic and Trade Committee reaffirmed cooperation in manufacturing, climate technologies, and market access. Hydrogen energy was identified as a strategic area of collaboration, with both sides supporting joint projects in green hydrogen production and infrastructure. China has also signaled further opening of its financial markets to foreign institutions, including German asset managers and insurance companies. These developments indicate continued interest in deepening institutional and investment ties under a more regulated framework.

Find Business Support

The current policy environment reflects both regulatory tightening and renewed political engagement between China and Germany. Bilateral dialogue is gaining momentum as both sides seek to manage strategic differences while preserving economic cooperation into 2026. During the most recent China–Germany Joint Economic and Trade Committee meeting, officials reaffirmed their commitment to collaboration in automotive innovation, hydrogen energy, and industrial decarbonization. Chancellor Friedrich Merz is expected to visit China later this year—his first visit since taking office—which signals continuity in dialogue even under a more security-conscious policy framework.

Merz has emphasized “de-risking without decoupling,” echoing broader EU strategy. While his administration is expected to scrutinize Chinese investment more closely and promote diversification of supply chains, it has also indicated interest in expanding cooperation in sectors where German competitiveness depends on access to China’s scale and innovation capacity. Upcoming bilateral consultations are likely to focus on practical mechanisms for reducing strategic dependencies while enhancing collaboration in green technology, electric mobility, and financial services.

For companies, this evolving policy context signals both operational challenges and strategic clarity. Market access will increasingly hinge on compliance, localization, and alignment with national industrial priorities. However, government support for joint innovation, hydrogen partnerships, and localized EV production also presents new opportunities for investors who engage proactively with the policy direction on both sides. Firms that position themselves as long-term partners in industrial upgrading—rather than purely exporters—will be best placed to benefit from the next phase of China–Germany economic engagement.

Trade performance and emerging trends

Recent data from Germany’s Federal Statistics Office shows that in January–August 2025, China regained its position as Germany’s top trading partner, surpassing the US. This shift was primarily driven by an 8.3 percent surge in imports from China to Germany, while German exports to the US declined amid newly imposed American tariffs. The development underscores how protectionist trade measures in third markets are reshaping bilateral trade flows.

| China – Germany Bilateral Trade (2020-2024) | ||||||

| Year | Total trade | China exports (US$, billion) | China imports (US$, billion) | YoY change (%) | China exports change (%) | China imports change (%) |

| 2020 | 191.92 | 86.807 | 105.11 | – | – | – |

| 2021 | 235.10 | 115.18 | 119.92 | 22.5 | 32.7 | 14.1 |

| 2022 | 227.63 | 116.23 | 111.40 | -3.2 | -0.9 | -7.1 |

| 2023 | 206.90 | 100.63 | 106.27 | -9.1 | -13.4 | -4.6 |

| 2024 | 201.94 | 107.11 | 94.83 | -2.4 | 6.4 | -10.8 |

Source: International Trade Centre, General Administration of Customs, China (GACC)

Total bilateral trade decreased modestly in 2024. German exports to China declined as Chinese domestic production capacities expanded in automotive components and machinery. Meanwhile, China’s exports to Germany rebounded in the second half of 2024, supported by strong demand for electric vehicles, batteries, and renewable energy equipment. Despite a decline in 2024 trade volumes, structural interdependence in manufacturing and green technology continues to anchor bilateral value chains.

Find Business Support

Germany’s export profile shows a consistent dependence on advanced manufacturing. Machinery, automotive parts, chemical products, and precision instruments continue to dominate outbound trade. However, export volumes have trended downward over the past two years as China increased domestic substitution and prioritized local innovation in high-tech sectors. The only areas showing stable or improving demand are related to energy-efficiency technologies, pharmaceutical products, and automation equipment, indicating a shift toward value-added exports aligned with China’s industrial upgrading goals.

| Germany’s Top Exports to China, 2024 | |

| Category | Value (US$ billion) |

| Vehicles other than railway or tramway rolling stock, and parts and accessories thereof | 21.13 |

| Nuclear reactors, boilers, machinery, and mechanical appliances; parts thereof | 20.71 |

| Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles | 20.09 |

| Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof | 9.06 |

| Pharmaceutical products | 4.40 |

Source: International Trade Centre

China’s exports to Germany reflect rapid gains in green and digital economy sectors. Electric vehicles, lithium-ion batteries, solar panels, and consumer electronics have overtaken traditional goods such as furniture and textiles. Germany is importing more EVs from China as domestic automakers face cost pressures and transition challenges. Renewable energy products are seeing accelerated growth as Germany pursues its 2045 carbon-neutrality target. However, this rise has triggered regulatory scrutiny from the European Commission, leading to subsidy investigations and potential countervailing duties.

| China’s Top Exports to Germany, 2024 | |

| Category | Value (US$ billion) |

| Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles | 33.29 |

| Nuclear reactors, boilers, machinery, and mechanical appliances; parts thereof | 20.55 |

| Vehicles other than railway or tramway rolling stock, and parts and accessories thereof | 6.35 |

| Furniture; bedding, mattresses, mattress supports, cushions, and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated nameplates, and the like; prefabricated buildings | 5.07 |

| Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof | 4.02 |

Source: International Trade Centre

Looking ahead to 2026, growth is expected to be led by technology-driven sectors rather than traditional industrial trade, signaling a structural shift in bilateral economic dynamics. Bilateral trade is moving toward high-tech and green industries, signaling a transition from volume-based exchanges to strategic, innovation-led value chains.

Nevertheless, the EU’s trade measures, including EV subsidy probes and the CABM, heighten regulatory uncertainty. Under a baseline scenario, trade levels will stabilize, with a slight recovery in high-value segments as both economies implement stimulus measures. Under a protectionist escalation scenario, trade in EVs and electronics may face tariffs or quotas, possibly leading to supply chain reconfiguration.

Bilateral investment flows

German investment in China is increasingly shifting toward localized R&D hubs, with Volkswagen’s Hefei facility serving as a key example. Designed to accelerate electric vehicle development and shorten production cycles, the site recently received an additional €2.5 billion (approximately US$2.7 billion) to expand R&D and manufacturing capacity, signaling a strategic focus on faster model turnover and region-specific technologies.

Find Business Support

Meanwhile, long-cycle investments remain anchored in the chemicals sector. The BASF Zhanjiang project reflects a deeper structural shift, as German firms integrate R&D and engineering capabilities within China to enhance supply chain resilience and align more closely with downstream demand.

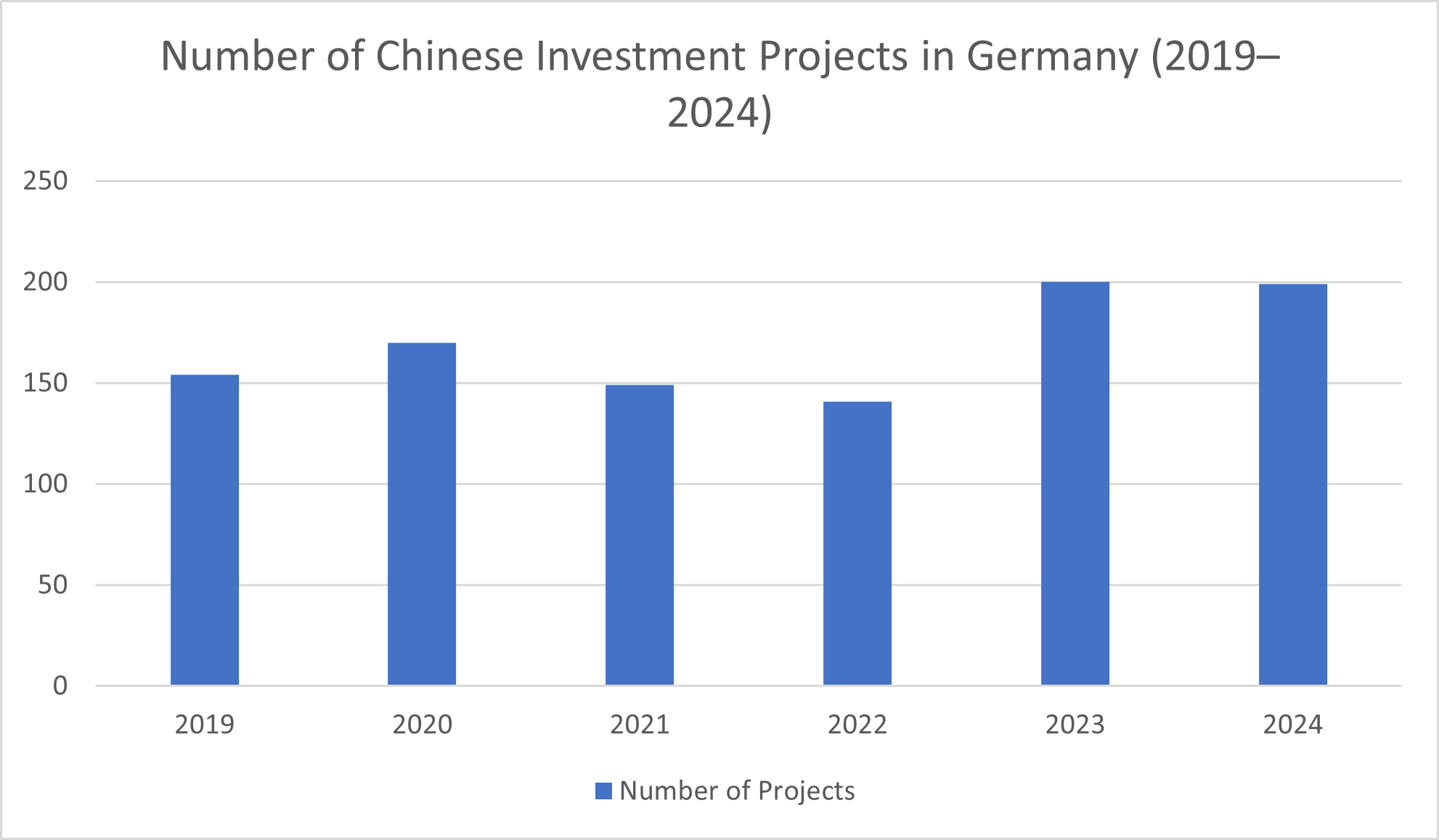

On the other hand, Chinese FDI in Germany continues to expand through greenfield and expansion projects, even as investment screening becomes more stringent. In 2024, Germany recorded 1,724 FDI projects (excluding mergers and acquisitions), close to its five-year average. China accounted for roughly 200 of these, one of the highest country-level contributions, with a strong focus on renewables, digitalization, and integrated production and R&D. This trend reflects deeper industrial engagement in areas such as energy storage components, power electronics, logistics technologies, and data infrastructure. However, project approvals are increasingly subject to security and subsidy reviews, signaling a more cautious regulatory environment.

Source: Germany Trade & Invest (GTAI), Federal State Economic Development Agencies, 2025

The Chinese Ministry of Commerce notes that while Chinese investment in Germany remains diverse – ranging from finance to automation to machinery to new energy – investors should prepare for tighter rules, higher compliance costs, and political risk events (for example, supply-chain and data-security legislation). These advisories align with Germany’s more stringent screening of acquisitions in critical technologies and infrastructure.

| China’s Direct Investment in Germany, 2019–2024 (US$ billion) | ||||||

| Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Annual flow | 1.5 | 1.4 | 2.7 | 1.0 | 1.8 | 2.3 |

| Year-end stock | 14.2 | 14.6 | 16.7 | 17.7 | 20.4 | 18.0 |

Strategic sectors driving the next phase of relations

As geopolitical tensions and regulatory scrutiny reshape bilateral ties, China and Germany are shifting from traditional trade dependence to more strategic forms of industrial cooperation. Rather than decoupling, both sides appear to be moving toward a calibrated “de-risking with engagement” model, prioritizing sectors critical for technological leadership, energy security, and long-term competitiveness. The following industries illustrate how competition and collaboration are unfolding simultaneously, with varied implications for investment planning.

Automotive and electric vehicles

EV trade is becoming a focal point of both market integration and regulatory scrutiny, as Chinese manufacturers expand in Europe and German firms deepen local EV operations in China. The EU’s anti-subsidy tariffs on Chinese EVs are likely to stay in place, raising cost pressures for Chinese manufacturers entering the European market. However, German automakers are doubling down on their China strategies to retain competitiveness in the electric transition. Volkswagen’s expanded partnerships in battery innovation and localized platforms underscore the sector’s continued interdependence. Despite political friction, China will remain a core profit and innovation hub for German automotive groups, with EV demand expected to grow steadily in 2026.

Green hydrogen and energy transition

Green hydrogen is emerging as a strategic hedge against geopolitical tensions, driven by mutual decarbonization goals. The two countries have institutionalized cooperation through the Sino-German Energy Partnership, focusing on green hydrogen, carbon capture, and industrial decarbonization. This sector is projected to continue attracting strategic investment into 2026 through joint pilot projects and hydrogen infrastructure development, positioning it as one of the few areas where geopolitical alignment and commercial incentives clearly converge

Advanced manufacturing and automation

German firms remain key suppliers of robotics, precision machinery, and industrial software for China’s New Quality Productive Forces agenda, which is driving strong demand for automation solutions. However, export controls and the EU’s economic security framework are beginning to reshape commercial strategies. Companies face a dual mandate: capturing market opportunities in China’s manufacturing upgrade, while ensuring compliance with EU and US export control regimes, alongside China’s security reviews for sensitive technology imports. As such, 2026 is likely to be defined by selective engagement rather than volume-driven growth.

Healthcare and life sciences

Demographic pressures and rising healthcare costs in Germany are driving sustained demand for medical devices, pharmaceutical innovation, and digital health solutions. Chinese companies have shown growing interest in this sector, particularly in telemedicine, wearable devices, and biotechnology partnerships. Meanwhile, German medical technology firms continue to view China as a key growth market due to its aging population and expanding middle class. The healthcare sector is expected to see increased licensing agreements and cross-border clinical collaboration in 2026, provided companies can navigate stringent regulatory requirements related to data governance and patient privacy.

Strategic outlook and business implications

China and Germany are entering a new phase of economic ties that are more strategic and technology-driven than in previous decades. Companies are no longer competing on scale alone but are repositioning to capture value in innovation, energy transition, and digital transformation, while adapting to a more regulated and politically sensitive operating environment.

German firms are implementing dual strategies: deepening localization in China to retain market share while diversifying production to Southeast Asia and India to hedge geopolitical risk. This model allows continued access to China’s scale and innovation ecosystem without overexposure to regulatory disruptions.

Find Business Support

Compliance has become more strategic. Sustainability and due diligence regulations, such as supply chain traceability, ESG reporting, and carbon disclosure, influence how German firms structure their global operations. In contrast, Chinese rules on data governance, cybersecurity, and market access directly regulate the operations of these firms within China. As a result, companies must comply with both regulatory systems simultaneously to ensure continued access to the Chinese market while meeting obligations to European stakeholders. Those that invest early in regulatory adaptation gain a competitive edge by reducing legal risk and building trust with both European and Chinese authorities.

The risk environment will remain fluid. Increased EU tariffs on Chinese electric vehicles or retaliatory measures from China could disrupt specific sectors. Currency volatility, ongoing energy transition regulation, and potential shifts in subsidy policy may influence capital flows and operational cost structures. However, these risks are counterbalanced by strong economic interdependence and aligned strategic priorities in green technology, hydrogen development, automation, and healthcare.

Under the baseline scenario, bilateral economic engagement will deepen in sectors that support dual transition goals of decarbonization and digitalization. Firms that integrate into domestic innovation ecosystems and align with national industrial priorities will capture long-term growth. Strategic opportunities will concentrate on electric mobility, hydrogen production, industrial automation, biopharmaceuticals, and cross-border financial services.

For investors, the strategic priority in 2026 is to move from transactional market participation to embedded value creation. This requires deepening localization while maintaining EU compliance frameworks, targeting sectors backed by policy incentives, and engaging in collaborative innovation platforms. Financing channels such as green bonds, RMB-settled trade, and cross-border capital market schemes will play a greater role in bilateral economic integration.

The future of the relationship will depend on whether both economies can convert industrial interdependence into sustained innovation and competitive advantage.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at [email protected] or visit our website at www.dezshira.com.

link