Goosehead Insurance (GSHD): Revisiting Valuation After Q3 Growth, Digital Investment, and Share Buyback

Goosehead Insurance (GSHD) drew investor focus after reporting double-digit revenue growth and notable franchise expansion for the third quarter. The company also completed a share buyback and continued investments in its digital agent platform.

See our latest analysis for Goosehead Insurance.

Despite eye-catching revenue gains and fresh franchise openings, Goosehead Insurance’s share price is still feeling the after-effects of a tough year, with a year-to-date decline of nearly 30%. Recent momentum picked up with a 10% share price return over the past week after the earnings and buyback news, but the 1-year total shareholder return remains firmly negative at minus 28%. Still, investors with a longer view will note a nearly doubling in total returns over three years, suggesting the growth story may not be fully written yet, even if sentiment remains cautious for now.

If you’re weighing up what else might be shaking up the market, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

Given all of the growth headlines and recent share buybacks, does Goosehead Insurance’s beaten-down share price signal an undervalued entry point, or is the market already reflecting its future ambitions in the price?

Most Popular Narrative: 24.7% Undervalued

Compared to the last close price, the most widely followed narrative values Goosehead Insurance much higher. This suggests that investors might be overlooking something significant in its growth outlook. The market’s skepticism is notable, especially since the fair value estimate significantly exceeds current levels.

Rapid adoption of Goosehead’s proprietary AI and digital platforms is driving lower servicing costs and improved client experience. This positions the company to benefit from rising consumer demand for seamless, tech-enabled insurance solutions. As a result, operating leverage is expected to expand and net margins may improve over time.

Read the complete narrative.

Curious what drives this ambitious valuation? Behind the scenes: aggressive margin expansion, rapid client wins, and a financial leap that challenges industry norms. Explore how bullish assumptions on efficiency and market access could make or break this story. What key numbers power the narrative’s target? Find out inside.

Result: Fair Value of $98.10 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, rising climate risks and the challenge of sustaining franchise agent growth could quickly disrupt these bullish expectations. This keeps downside risks in focus.

Find out about the key risks to this Goosehead Insurance narrative.

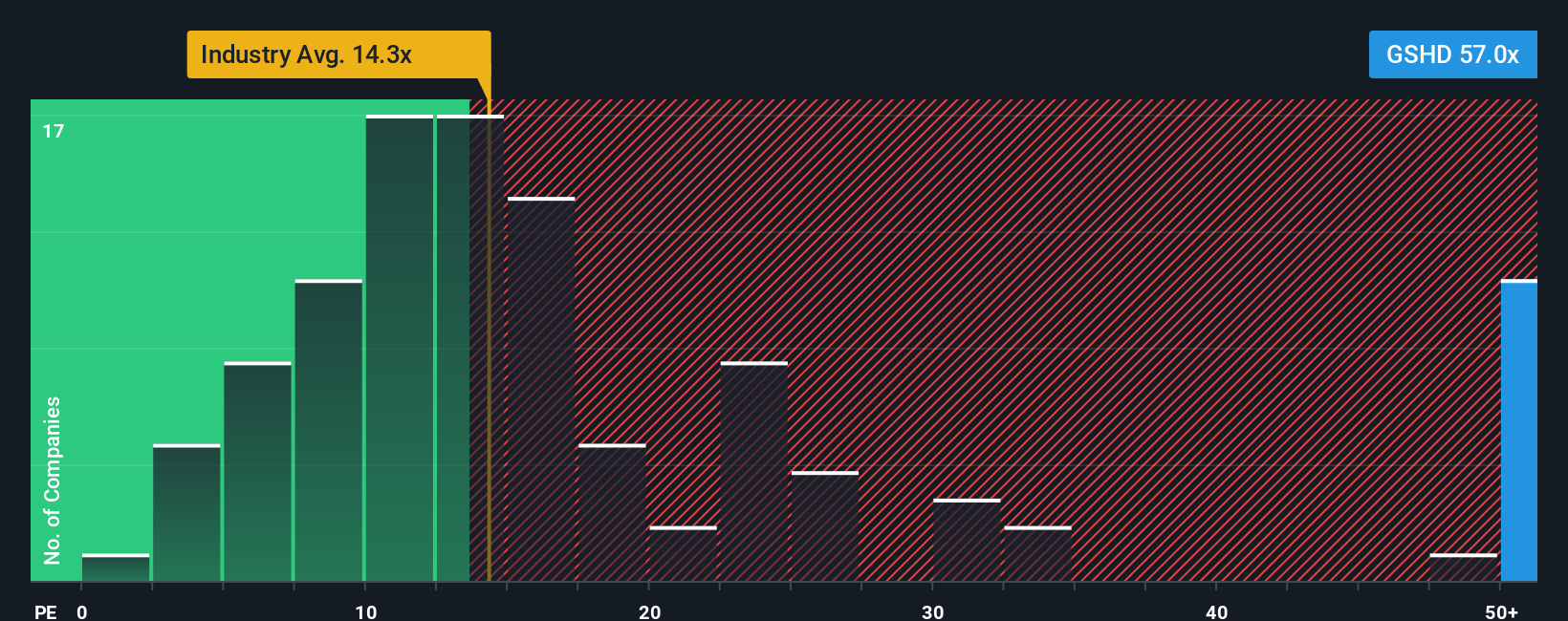

Another View: Do High Multiples Cloud the Picture?

Looking through the lens of the price-to-earnings ratio, Goosehead Insurance trades at 61.3 times earnings, a sharp premium to both the US Insurance sector average of 13.5 and its peer group at 47.8. The market’s fair ratio for Goosehead is just 23.1, which suggests the stock’s valuation could be running hot. Will future growth meet lofty expectations, or has optimism run ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goosehead Insurance Narrative

If you think the story could play out differently, or want to dig into the numbers on your terms, you can build your own perspective in just minutes. Do it your way

A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop learning. Unlock new opportunities and see what the market’s brightest minds are tracking by searching for stocks beyond the obvious choices:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link

:max_bytes(150000):strip_icc()/GettyImages-849880126-81c2593ab3ce422b9c57947331c9db44.jpg)