Report explores the adjacent markets that are fuelling investment opportunities in women’s professional sports

Women’s sports are no longer a side category in the world of sports investment—they are a high-growth commercial asset class with institutional capital flowing in, valuations accelerating and scalable-adjacent businesses emerging.

In recent years, women’s sports leagues such as the WNBA and WNSL have experienced significant growth. Global revenues in women’s elite sports are predicted to reach US$2.35 billion in 2025, reflecting an increase of 240 percent over four years, according to Deloitte . As women’s sports leagues mature and audiences grow, the investment potential goes beyond individual teams and athletes: the most compelling investment opportunities are emerging in the infrastructure that surrounds the game, including merchandise, sports technology and media.

Dedicated to supporting women’s sports across several important areas, RBC launched a research series in collaboration with Wasserman and The Collective, Wasserman’s women-focused division. Part 1 of The New Economy of Sports report examined the athlete income gap and the opportunities women athletes present to brands, sponsors and investors. Part 2 of the report highlighted the growth trajectory and increasing valuations of women’s sports teams and leagues and the impact of audience engagement on league value.

Part 3 of the report seeks to:

- Reveal a rapidly evolving business sector driven by innovative models disrupting the traditional sports landscape

- Highlight the adjacent businesses and emerging professional leagues that benefit from and accelerate the growth of the women’s sports ecosystem

- Explore the multiplier effect of these adjacencies, raising the valuation ceiling for teams, leagues and athletes across the ecosystem

“Across The New Economy of Sports research series, women’s sports consistently emerge as one of the most dynamic and scalable growth engines in the industry today,” says Alyson Walker, senior vice president, strategy and growth at The Collective. “The new infrastructure, investment and innovation surrounding women’s sports will shape the next era of the global sports business.”

Building a diverse capital structure

Financial infrastructure is still emerging in the women’s sports network, and early-stage investors have a rare chance to shape the industry. For example, expansion valuations are climbing rapidly, with record new team expansion fees reported in 2025.

Valuations on the rise: Record-making capital in women’s leagues

“The most valuable WNBA franchise, the Golden State Valkyries, is valued at $500 million, with an average franchise value of $269 million ,” says Luana Harris, managing director, RBC Sports Advisory. “For the NWSL, at the top is Angel City FC at $280 million, with an average franchise value of $134 million . Those are impressive numbers that continue to grow at high multiples. With this growth comes the opportunity for business around women’s sports, such as venues, merchandise and tech innovation.”

High-profile celebrity investors like Serena Williams, Jennifer Garner and Magic Johnson are backing women’s sports teams, elevating the profile and signaling the industry’s potential. Beyond investing in leagues and teams, investments in data rights, athlete-management platforms and other institutional frameworks are diversifying the world of sports finance.

Recent infusions of institutional capital in the women’s-sports landscape have resulted in a number of financial vehicles such as dedicated women’s-sports funds and sport technology accelerators, offering investors broad new opportunities in the space.

Emerging and evolving sports represent high-growth opportunities

Women’s professional basketball and soccer continue to experience exponential growth, according to the report, but that’s only the beginning. A number of emerging properties are being built from the ground up with digital-first strategies, global reach and equitable gender foundations.

For example, high-growth women’s sports like volleyball, cricket, rugby and softball are expanding at a faster rate than legacy sports, and they feature rapidly rising revenues and valuation multiples. Women’s volleyball, for example, is benefitting from venue-naming rights and other sponsorship innovations. The 2028 Olympic Games, in Los Angeles, represents a pivotal moment for the growth and commercialization of women’s sports, with opportunities for global visibility, commercial validation and new monetization pathways in media, sponsorships and intellectual property.

Olympic spotlight: The amplification effect of the world’s largest global sporting event

Unlocking the infrastructure gap in women’s sports

As interest and investment in women’s sports explode, these athletes still operate in environments that were not designed specifically for them. From facilities to data systems, female athletes widely use resources that were designed for and tested on their male counterparts. For example, only 35 percent of sports science includes research on females, and only six percent focuses on female physiology.

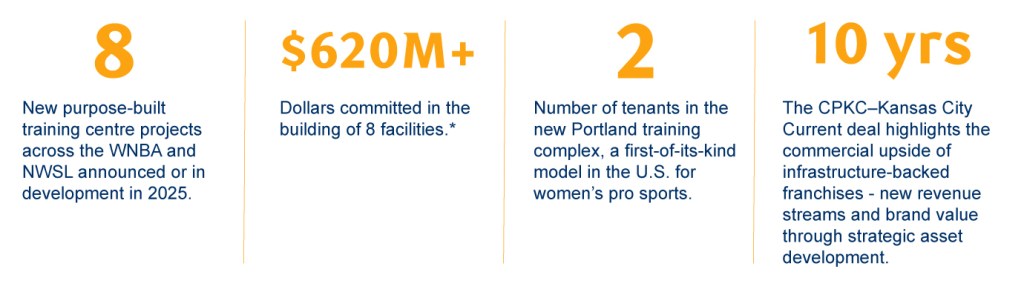

That gap represents additional opportunities for investment, with needs for developing athlete-specific technology, performance insights and scalable innovation. In addition, most women’s professional teams lack dedicated facilities, representing a high-potential opportunity for infrastructure investment. Interested investors can consider a wealth of opportunities across the women’s sports landscape, including performance, infrastructure, training complexes and equipment, and data commercialization. Eight new women’s training facilities were announced, or are in development, across the WNBA and NWSL in 2025, representing a commitment of more than $620 million. This includes a new state-of-the-art facility under construction in Portland, designed exclusively for women athletes, which will be used by local WNBA and NWSL teams.

Purpose-built facility growth

* Aggregate figure calculated based on publicly reported capital commitments for eight WNBA and NWSL training facility projects. Source reporting includes: Sports Business Journal (multiple articles), Sportico, The Athletic, ESPN, and team press releases (2024–2025).

“It’s a very exciting area of the sports system, but caution still needs to be exercised when looking at women’s emerging sports teams and leagues,” Harris says. “While the growth has been positive, it’s important to work with a professional advisor and do your due diligence when exploring these types of investments.”

Read the full report

Learn more about the evolving business ecosystem surrounding women’s sports, including the opportunities it presents to investors, in The New Economy of Sports–Part 3: Adjacent Markets Powering Women’s Sports .

About The Collective

As a division of Wasserman, The Collective exists to create change in support of equity and fairness for women in sports and entertainment. As a constantly evolving and complicated target, The Collective distills data regarding women’s mindsets, desires, lifestyle and more into actionable insights and marketing strategies for brands, properties and talent. In collaboration with a global consortium of today’s greatest academic minds and industry leaders, The Collective delivers a holistic and deep understanding of women as consumers, fans, professionals and individuals.

This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc.*, RBC Phillips, Hager & North Investment Counsel Inc., RBC Global Asset Management Inc. Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their affiliate, Royal Mutual Funds Inc. (RMFI). *Member – Canada Investor Protection Fund. Each of the Companies, RMFI and Royal Bank of Canada are separate corporate entities which are affiliated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and licensed representatives of RMFI, Investment Counsellors who are employees of RBC Phillips, Hager & North Investment Counsel Inc., Portfolio Managers who are employees of RBC Global Asset Management Inc., Trust Advisors and Will and Estate Advisors who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC Dominion Securities Inc. In Quebec, financial planning services are provided by RMFI which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RMFI or RBC Dominion Securities Inc. Estate and trust services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If specific products or services are not offered by one of the Companies, clients may request a referral to another RBC partner. The strategies, advice and technical content in this publication are provided for the general guidance and benefit of our clients, based on information believed to be accurate and complete, but neither the Companies, RMFI, nor Royal Bank of Canada, nor any of its affiliates nor any other person can guarantee accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a qualified legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, Royal Bank of Canada nor any of its affiliates nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. In certain branch locations, one or more of the Companies may carry on business from premises shared with other Royal Bank of Canada affiliates. Notwithstanding this fact, each of the Companies is a separate business and personal information and confidential information relating to client accounts can only be disclosed to other RBC affiliates if required to service your needs, by law or with your consent. Under the RBC Code of Conduct, RBC Privacy Principles and RBC Conflict of Interest Policy confidential information may not be shared between RBC affiliates without a valid reason.

RBC Wealth Management is a business segment of Royal Bank of Canada. Please click the “Legal” link at the bottom of this page for further information on the entities that are member companies of RBC Wealth Management. The content in this publication is provided for general information only and is not intended to provide any advice or endorse/recommend the content contained in the publication.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2025. All rights reserved.

link

:max_bytes(150000):strip_icc()/GettyImages-485585354-603e9a60c6ee4b2bb1659bff7b92e0d6.jpg)