Is Analog Devices (ADI) Sacrificing Efficiency for Long-Term Growth in Its Latest Investment Strategy?

- In late September 2025, Analog Devices presented at the HFSA conference in Minneapolis as investors evaluated new developments in the company’s financial performance and strategy.

- Recent updates highlighted a decrease in Analog Devices’ return on capital employed despite higher investment levels, causing investor sentiment to trend toward cautious optimism about future long-term returns.

- We will explore how the company’s declining return on capital employed and increased long-term investments impact its overall investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Analog Devices Investment Narrative Recap

To be a shareholder in Analog Devices, I believe you have to look beyond quarterly returns and trust in the company’s ability to turn long-term investment into enduring growth, despite near-term pressure on profitability. The recent conference update and softer return on capital signs seem unlikely to dramatically shift the main short-term catalyst, recovery in industrial and automotive demand, or meaningfully reduce the current risks, particularly from elevated capital expenditures outpacing sales momentum.

Among recent updates, the reported decline in return on capital employed, from 7.5% five years ago to 5.8% currently, stands out. This trend is central to the potential challenge that ongoing investment may not deliver immediate revenue uplift, placing renewed focus on whether these investments can eventually lift margins and returns as demand recovers.

Yet, what many investors need to keep an eye on is the growing gap between capital investment and current sales, especially if …

Read the full narrative on Analog Devices (it’s free!)

Analog Devices’ outlook anticipates $14.3 billion in revenue and $4.9 billion in earnings by 2028. This scenario depends on achieving 11.3% annual revenue growth and a $2.9 billion increase in earnings from the current $2.0 billion.

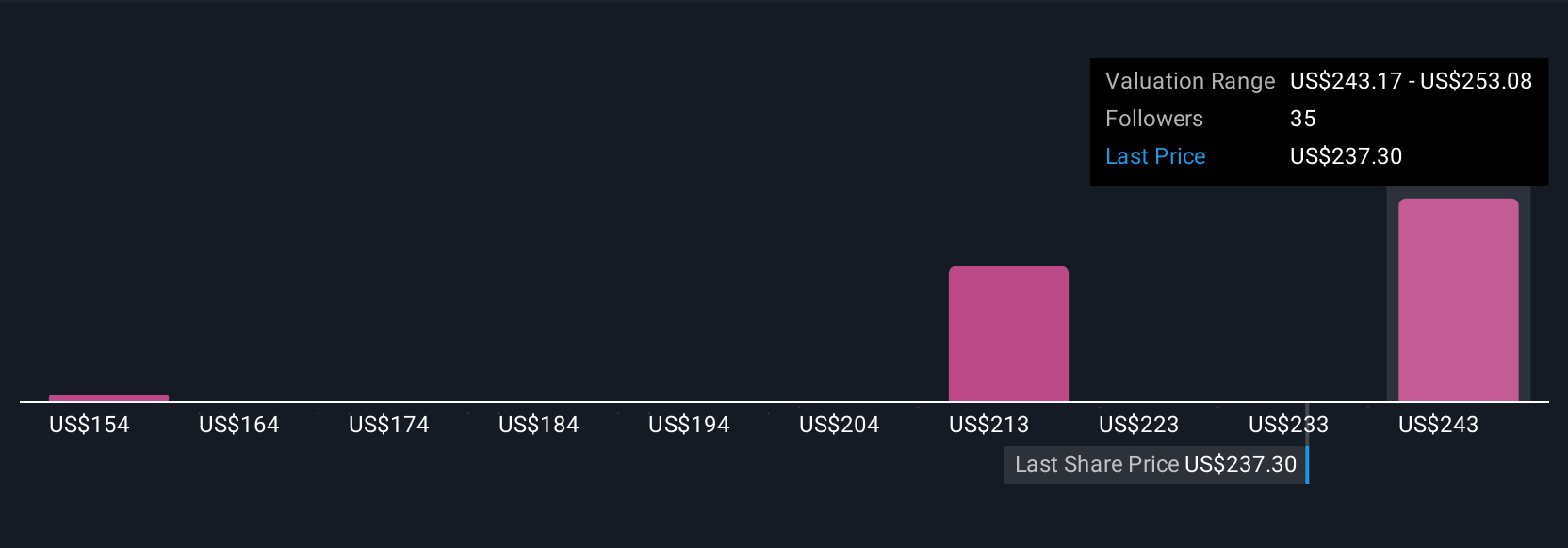

Uncover how Analog Devices’ forecasts yield a $267.47 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published nine fair value estimates for Analog Devices, ranging from US$157.50 to US$310. With such wide differences, it is clear opinions diverge, especially as ongoing increases in capital spending continue to shape the debate about future returns. Consider these multiple viewpoints as you form your own outlook.

Explore 9 other fair value estimates on Analog Devices – why the stock might be worth 35% less than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link