Crombie REIT (TSX:CRR.UN): Assessing Valuation as Montreal Development Project Breaks Ground

This expansion fits right into the bigger picture for Crombie. Over the past year, the stock has risen just over 1%, with stronger momentum since January as shares climbed nearly 14% year to date. The company’s three-year total return sits above 16%, and its five-year return tops 54%, suggesting that Crombie’s development pipeline and community investments are steadily building value. Recent gains may indicate that investors are warming up to its growth prospects, but also that risk perceptions are shifting as the REIT expands.

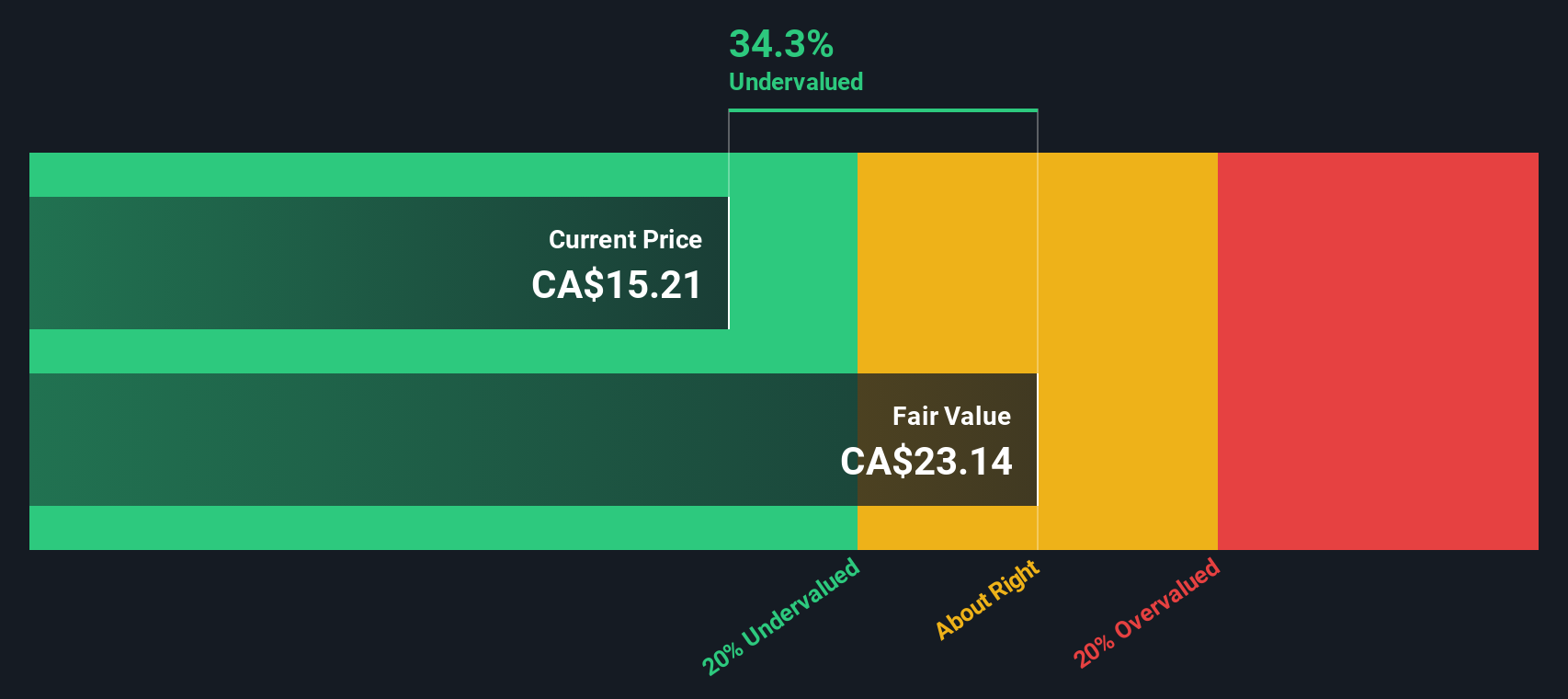

Now, with Crombie making headlines for a major new project and its stock on the move this year, the big question is whether there is real value left for new investors or if the market has already priced in future growth.

Price-to-Earnings of 17.3x: Is it justified?

Crombie REIT is trading with a price-to-earnings ratio of 17.3x, which suggests the shares are attractively valued compared to many North American retail REIT peers.

The price-to-earnings (P/E) ratio gauges how much investors are willing to pay per dollar of earnings. For real estate investment trusts, a moderate or lower P/E can indicate that the market has yet to fully recognize ongoing operational improvements or future growth potential.

With Crombie’s P/E below the industry average, it appears investors might be underestimating the impact of recent earnings growth and the company’s consistent performance. This lower multiple could present an opportunity if momentum in profitability continues.

Result: Fair Value of $23.06 (UNDERVALUED)

See our latest analysis for Crombie Real Estate Investment Trust.

However, Crombie’s momentum could stall if retail leasing demand softens or if higher rates limit the pace of profitable development.

Find out about the key risks to this Crombie Real Estate Investment Trust narrative.

Another View: SWS DCF Model Weighs In

Taking a step back from earnings multiples, our SWS DCF model offers a different perspective. This approach also suggests Crombie is undervalued, providing reinforcement for the first assessment. Could both methods be on the mark, or is something flying under the radar?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Crombie Real Estate Investment Trust to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Crombie Real Estate Investment Trust Narrative

If you see the story differently or want to put your own analysis to the test, you can dig into the numbers and craft a complete narrative in just a few minutes. Do it your way.

A great starting point for your Crombie Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on what’s next. Expand your opportunities and stay ahead by finding stocks that match your goals and interests using these tailor-made strategies:

- Unlock hidden gems by targeting companies that are financially solid, ambitious, and priced to impress with undervalued stocks based on cash flows.

- Supercharge your search with stocks innovating in healthcare, where artificial intelligence is transforming patient care and medical breakthroughs. Start with healthcare AI stocks.

- Catch early-stage opportunities in the market’s most promising small-cap players when you tap into penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link

:max_bytes(150000):strip_icc()/corp-social-responsibility_revised-dc9a157213de4872b2159fea8450ad13.png)